Clients > Development Finance

Development Finance

Development banks face increasing pressure to deliver tangible, measurable impact across diverse geographies and sectors. Reliable, science-based data is needed to manage risk, measure impact, and make evidence-driven decisions, even in hard-to-measure markets and sectors.

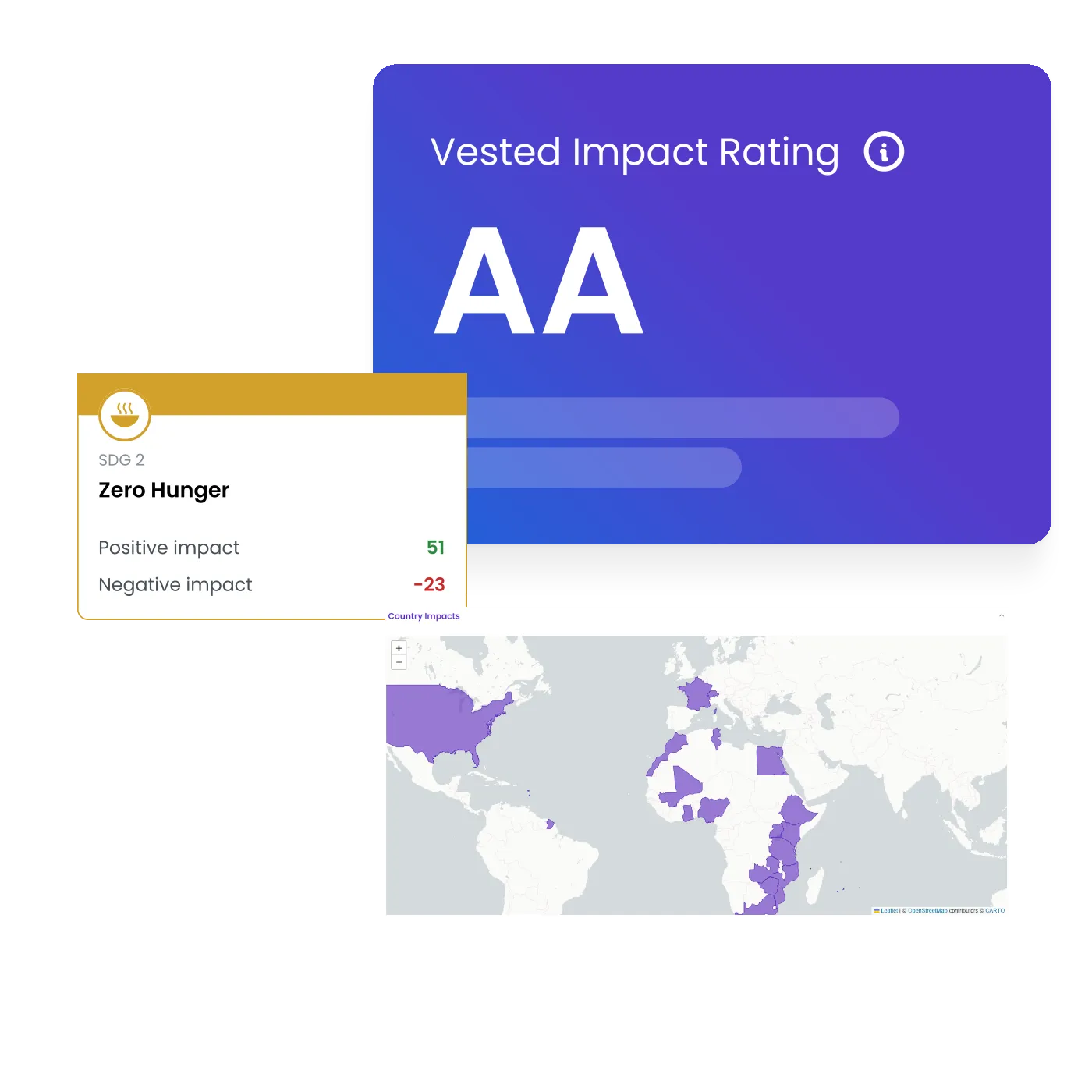

Vested Impact delivers standardised, comprehensive, on-demand impact insights, accelerating screening, reporting, and monitoring across all investment types, including individual projects and bond allocations.

Comprehensive Coverage in Emerging Markets

Access robust, science-backed data on regions and sectors where reliable impact information is often scarce, enabling evidence-based investment decisions even in hard-to-measure contexts.

Improved Efficiency in Impact Assessment

Enhance transparency, coverage, and efficiency in monitoring risks and impacts across individual projects and bond allocations at the activity level.

Actionable Insights Across the Investment Lifecycle

Access rapid, comparable insights across all asset classes, project types, and investment sizes - seamlessly integrated across the investment lifecycle, from origination to exit.

Unlock Access to Finance

Comprehensive, regulatory-aligned data that meets investor requirements and expands access to finance.

Supporting the full investment lifecycle

Vested Impact supports Developments Banks across the investment lifecycle:

1

Origination

Identify high-potential projects aligned with bank mandates, thematic priorities, and SDG goals. Our data highlights priority sectors, geographies, and activities to inform pipeline development.

2

Due Diligence

Screen investments for material ESG risks and development additionally with standardised, comparable metrics. Assess expected outcomes at the product, service, and activity level for evidence-based decisions.

3

Commitment & Structuring

Set clear impact KPIs, establish baselines, and design investments for measurable results. Align investment terms with frameworks such as IRIS+, 2X Challenge, or the 5 Dimensions of Impact.

4

Monitoring & Evaluation

Track implementation, measure outcomes, and manage risk across your portfolio. Reduce reporting burden while improving transparency and accountability for stakeholders.

5

Exit & Learning

Evaluate results, capture lessons learned, and inform future investment strategy. Demonstrate development effectiveness with robust, data-driven insights.

Get the risk intelligence you need

Complete the form and tell us a bit about your needs.

One of our team will be in

contact to see how we can help.