Solution

Solution

From independent one-off verifications to continuous screening & monitoring and full data integrations, Vested Impact offers flexible options to access our risk and impact intelligence:

Independent assessments

One-off, evidence-based verifications and second-party assessments across portfolios or instruments, with no onboarding required.

Platform access

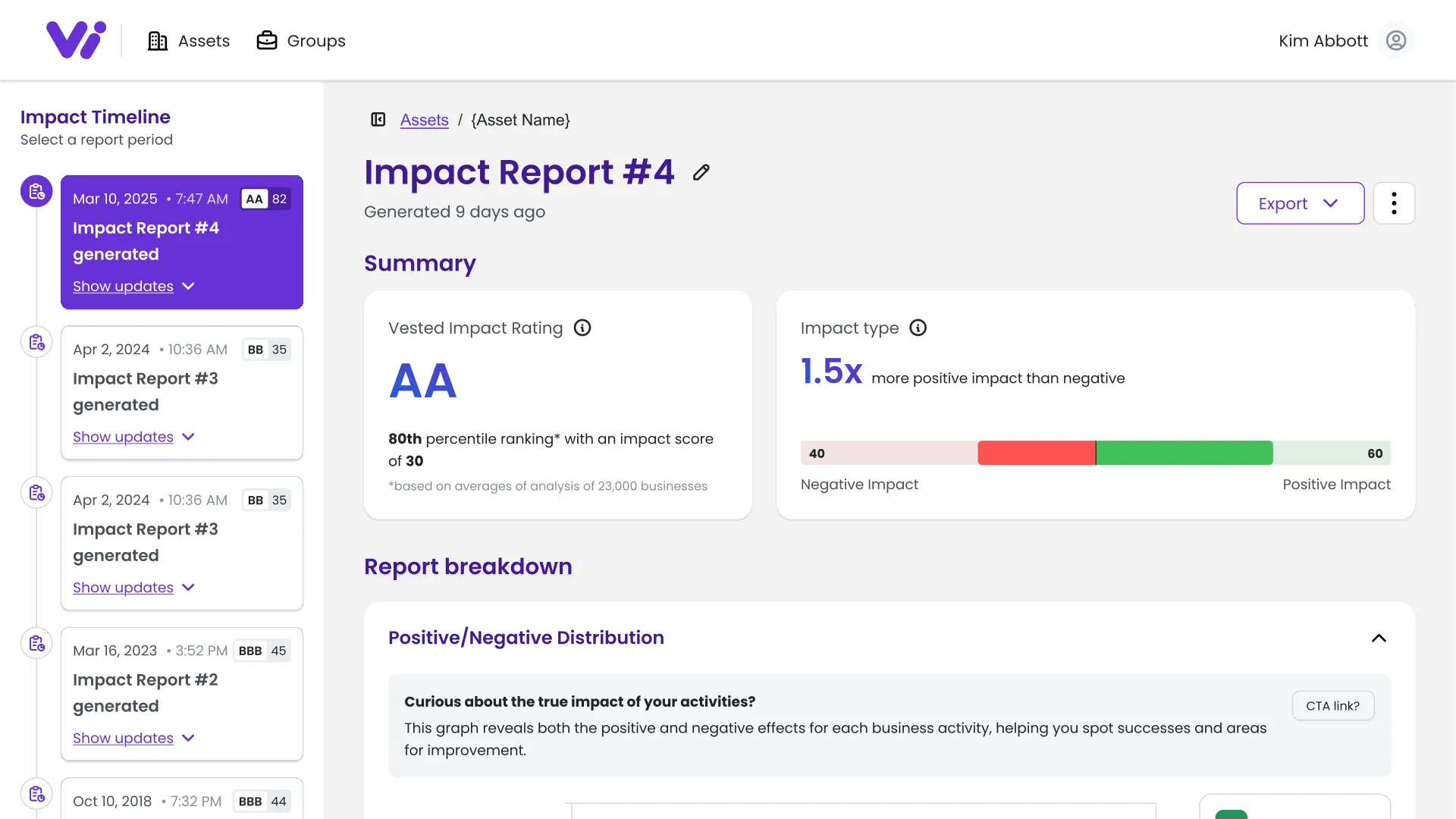

On-demand screening, analysis, risk management, and reporting through an intuitive, self-serve platform.

Impact data API

Seamless integration of our complete ESG risk and impact dataset into your internal systems, models, and workflows for on-demand and customisable access.

Platform

Accelerate screening, enhance risk management and improve portfolio-wide visibility on impact risk with our powerful platform analytics and exports. Our SME account supports individual companies, whilst our Pro account supports those who need to assess, monitor and manage multiple companies or assets as part of a group, portfolio or supply chain.

Instant screening

Evaluate any company, asset, or project in seconds. Fill impact and ESG data gaps automatically with science-backed, evidence-based insights to create complete, decision-ready profiles.

Custom groups & portfolios

Build bespoke asset groups, portfolios, and thematic baskets. Track exposures, monitor performance, and manage risk across public, private, fund-of-fund, and project-level holdings.

Benchmarking & comparison

Easily compare assets, portfolios, or peer groups to identify leaders, laggards, hotspots, and opportunities.

Export-ready reporting

Download polished PDF summaries for stakeholders and export detailed Excel data packs to support regulatory reporting, internal models, clients, and auditors.

Impact Data

Powering risk management, reporting, and investment decisions with the world’s most comprehensive, on-demand, science-backed impact and ESG risk dataset

Unmatched & unlimited coverage

Instant access to impact and ESG risk insights for any asset type—public, private, SME, project, or portfolio—spanning millions of entities across geographies, sectors, and 150+ ESG and impact topics.

Regulatory- and compliance-aligned

Asset-, product-, and activity-level assessments aligned with leading global frameworks, including GRI, SDR, SFDR, ISSB, CSRD, EU Taxonomy, and the UN SDGs.

Evidence-based and audit-ready

Generate defensible, audit-ready disclosures and risk assessments backed by 200M+ academic studies and 100M+ independent impact datapoints from globally recognised sources.

Interoperable and built for your workflows

Integrate seamlessly via API or Excel. Adapt outputs to your own methodologies or custom frameworks for tailored, portfolio-wide analysis.

How Vested Impact works

A science-based, structured, and scalable way to measure the material risks & impacts of any asset in seconds

1

Identify activities and markets

The platform supports mapping each company, project, or bond to its underlying activities and the countries where it operates or delivers products and services; Using a proprietary database built on TRBC, NAICS, and NACE classifications (plus custom categories).

2

Assess material risks & impacts based on scientific research

Vested Impact identifies what activities have a positive or negative material impact on leveraging over 200M academic articles to provide automated, auditable, science-based evidence of materiality and impact attribution pathways.

3

Calculate scale and scope of risks & impacts

Every activity-country-topic combination Vested Impact assesses and quantifies the degree of risk or impact, which is assessed across four equally weighted pillars that consider not just the activities, but the market and country context.

4

Identify flags for critical risks

Alongside scores, Vested Impact applies Flags to highlight key issues that require deeper due-diligence and engagement - from human rights and child labour risks to biodiversity, wetlands, and World Heritage concerns, as well as alignment with thematic frameworks such as Gender- and Child-Lens Investing.

5

Aggregate into a Vested Impact score or integrate into your own models

All activity-country-topic assessments are weighted by revenue or operational share to produce an overall Vested Impact score (ranging from -100 to +100) and a corresponding Impact Rating (AAA to D). This allows easy comparison across companies, portfolios, sectors, and geographies.

6

Deliver instant, auditable insights

All results are delivered via platform or API in minutes - reducing the cost and time of compliance, reporting, and monitoring. Every score and flag is transparent, auditable, and regulator-ready; and underlying scores and data is accessible for adaption into your own models and frameworks via the API.

The full methodology, including technical annexes, is available for download in our Resources section and/or on request

Get the risk intelligence you need

Complete the form and tell us a bit about your needs.

One of our team will be in

contact to see how we can help.